Coronavirus Update: April 3, 2020

by Jason Gunkel CFP® CFA CAP® Chief Investment Officer | April 3, 2020

The stock market has swayed back and forth this week as investors tried to digest the rapidly changing developments with the coronavirus and its effects on the economy. As of the end of Thursday, the S&P 500 stock index was relatively flat for the week. The first quarter of the year ended on Tuesday and the S&P 500 finished down almost 20%.

The market started the week with positive momentum after Congress passed a massive stimulus bill last Friday called the CARES Act. Part of the bill will provide $377 billion of grants and forgivable loans to small businesses, which will start to be available Friday. There is also optimism that more fiscal stimulus could be coming, perhaps in the form of huge infrastructure spending to help put people back to work.

However, the expanding pandemic has cast a cloud of uncertainty over the financial markets that will likely keep volatility high. According to John Hopkins University, the total number of people worldwide with the virus has surpassed one million. The U.S. now has the most confirmed cases of any country and President Trump has warned of a “painful” 2-3 week period ahead as death tolls rise.

The social distancing guidelines that remain in place have frozen the economy, and the unemployment rate in the U.S. has skyrocketed. The number of people who filed for unemployment benefits set a record for the week ended March 21 at over 3.3 million. However, a new record was set the following week ended March 28 at over 6.6 million new claims. The unemployment rate, which was at a record low 3.5% in February, is now estimated to be about 10% according to the Department of Labor.

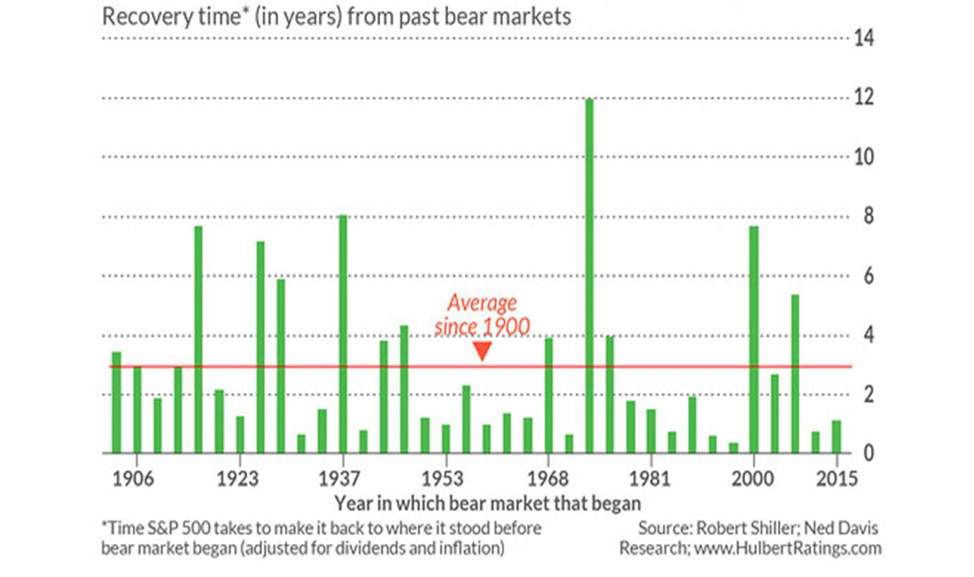

Investors are wondering how quickly the stock market might recover from its drop. The average time it takes for a market to recover from a 20% or more drop has been about three years. However, there have been several times when the market recovered faster and also times it took longer than three years. That is why we strive for our clients to have between three-and five-years’ worth of their investment withdrawals in the bond portion of their portfolios. This allows time for their stocks to recover in value while they can draw from the bond portion, which typically holds its value better.

The timing of the market recovery ultimately depends on how quickly we are able to defeat the coronavirus and people can get back to work. This could still take months and the stock market might drop further. However, try to remember that history shows the stock market has always recovered from market drops to reach new highs. In addition, we have tried to design investment strategies so that our clients are not forced to sell stocks while the market is still recovering. Our investment team will continue to monitor the markets and work in the best interest of our clients. We hope we can provide our clients with more peace of mind regarding their money, so they and their family can focus on staying healthy!