Coronavirus Update: March 20, 2020

by Jason Gunkel CFP® CFA CAP® Chief Investment Officer | March 20, 2020

The coronavirus pandemic has affected the daily lives of millions more Americans this week. Many businesses (including Syverson Strege) decided to send their workers home to work remotely. We are all trying to adjust to measures to combat the disease, including travel restrictions, school, business, and daycare closings, and social distancing.

The biggest news of the week was that both the Federal Reserve and Federal Government stepped up their efforts to help people affected by the virus, and tried to stabilize the financial markets. Congress passed a bill that will provide billions of dollars for free virus testing and paid sick leave for employees. In addition, Congress is currently discussing a stimulus package of over $1 trillion that could provide aid for businesses and direct payments to individuals. Some good news for taxpayers is that the Department of Treasury extended the tax filing deadline for both individuals and companies from April 15 to July 15, giving Americans an additional three months to file and pay their income tax returns.

Despite these measures, investors are fearing that a global recession is more likely. The stock market had another choppy week, bouncing back and forth between up and down days. As of the writing of this article, it appears the S&P 500 stock index will end the week down at least 10%. If businesses are forced to remain closed for an extended period, the unemployment rate could quickly spike and lead to two consecutive quarters of negative economic growth, which is the most common way to define a recession.

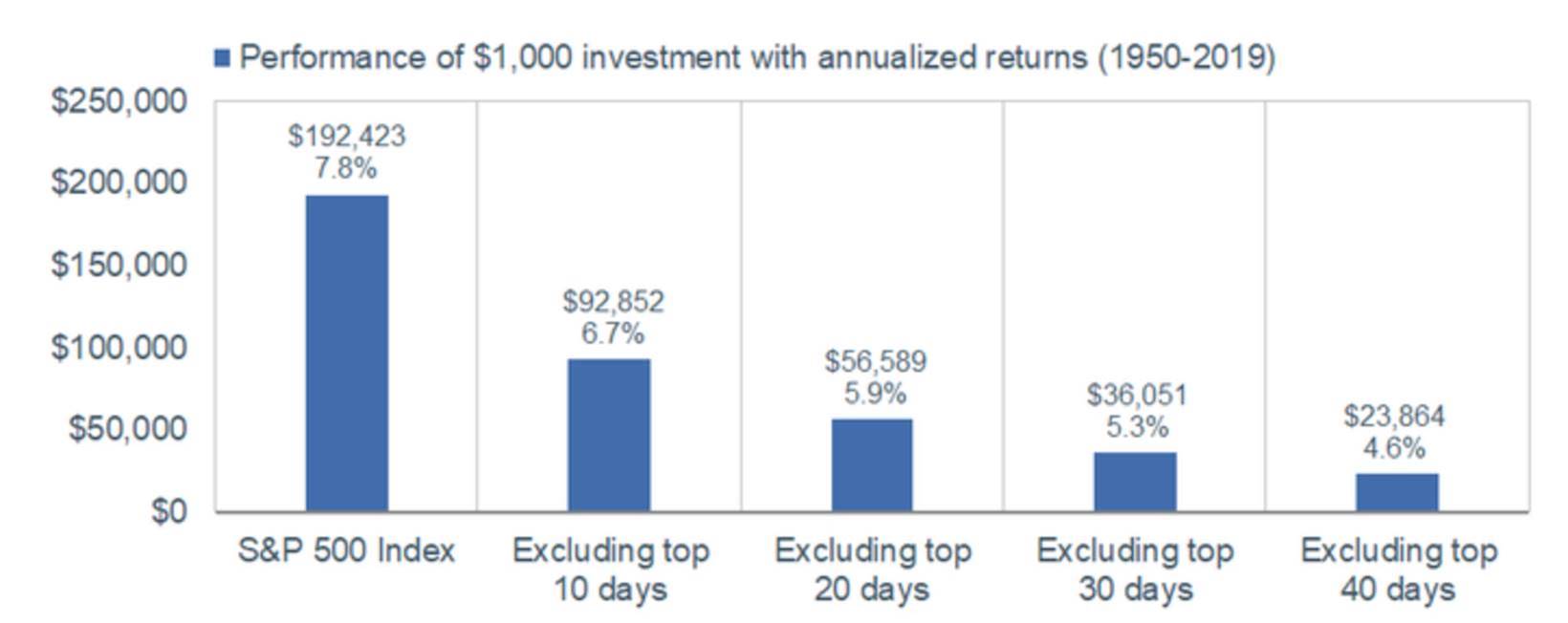

While things might seem grim, we encourage you not to panic. Panic is not an investment strategy. A common question from investors when the market is falling is whether or not they should sell their stocks and move to cash. They say they would rather be out of the stock market while it might drop further and retain the money they currently have. However, this is the worst move that an investor can make because they will almost certainly miss out when the stock market recovers. The graph below illustrates this point. Being out of the stock market for only 10 to 40 days over a period of 70 years can significantly deteriorate your returns!

Source: Schwab Center for Financial Research with data provided by Standard and Poor’s. The example is hypothetical and provided for illustrative purposes only. Return data is annualized based on an average of 252 trading days within a calendar year. The year begins on the first trading day in January and ends on the last trading day of December, and daily returns were used. Returns do not assume reinvestment of dividends and the example does not reflect the effects of taxes or fees. When out of the market, cash is not invested. Market returns are represented by the S&P 500® Index which represents an index of widely traded stocks (purple bar). Top days are defined as the best performing days of the S&P 500 during the seventy-year period. Indices are unmanaged, do not incur fees or expenses, and cannot be invested in directly. For more information, please see Schwab.com/IndexDefinitions. Past performance is no indication of future results.

The stock market is actually one of several “leading economic indicators” which changes direction before the economy shows any signs of doing so. Investors buy and sell stocks in anticipation of which direction the economy is headed. Therefore, it is likely that the stock market recovers well before the number of coronavirus cases in the U.S. peaks. As soon as investors see some “light at the end of the tunnel,” the stock market could recover quickly.

Let’s hope that “light” comes quickly…or at least some light and warm weather outside!

Also, in case you missed it, we shared some of our viewpoints and answered questions from clients in a video conference earlier in the week. You can watch the recording of that here.