Coronavirus Update: November 6, 2020

by Jason Gunkel CFP® CFA CAP® Chief Investment Officer | November 6, 2020

At the time of this writing, the presidential election is still undecided, and the stock market appears to be taking it mostly in stride. A contested election was feared to cause the markets to drop with added uncertainty. However, investors have seemed to focus instead on the likelihood of a split in Congress with the Democrats and Republicans maintaining their majorities in the House and Senate, respectively. The U.S. stock market (as represented by the S&P 500 Index) has rallied following election day with it up over 4%.

A divided Congress is usually seen as a positive for financial markets. With a mixed majority in Congress, it is harder to pass legislation, and investors like the added likelihood of no significant changes in policy that could negatively affect the markets.

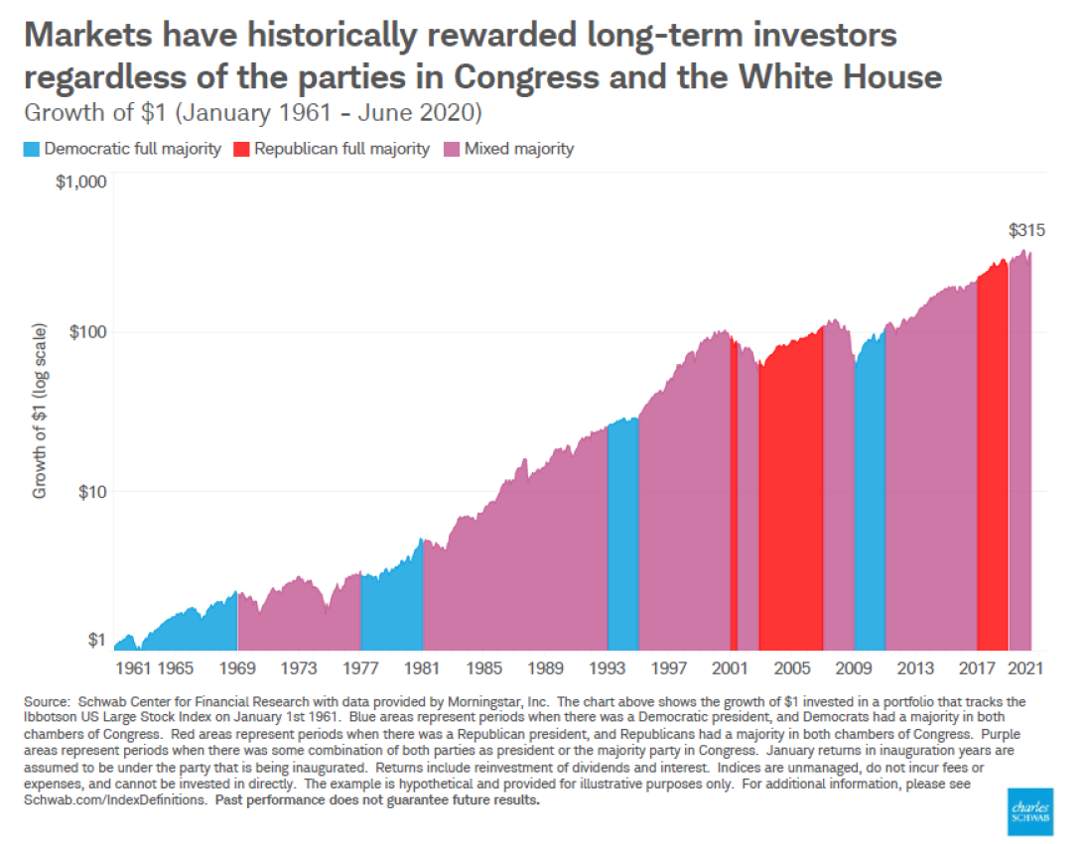

The chart below shows the growth of the stock market since 1961 under Democratic, Republican, and a mixed majority Congress. A divided Congress (as shown in purple) is the most common scenario and the stock market has typically done quite well when that is the case, according to Schwab.

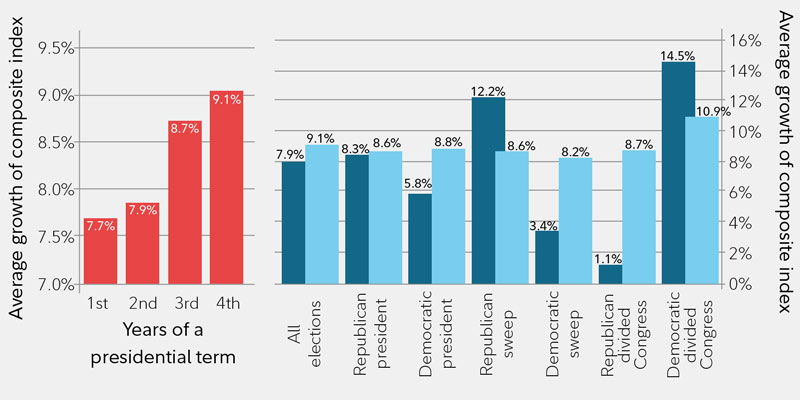

This second chart shows a little more detail on the effect a presidential election has on the stock market. Over a four-year presidential cycle, the U.S. stock market averages a return just over 9% per year under all election result scenarios. However, having a Democratic president and a divided Congress historically has had the biggest positive effect on the markets, with an average annual return of almost 11%. This is a relatively uncommon occurrence with it only happening six times since 1789, all according to research from Fidelity Investments.

Dark blue bars in the right panel indicate returns during the first 2 years of a president's term. The light blue bars show the 4-year return. Monthly data since 1789 (mix of S&P 500, Dow Jones Industrial Average, & Cowles Commission). Source: FMRCo

Perhaps the biggest positive of a divided Congress currently perceived by investors is that significant tax increases are very unlikely. While we have explained in the past that the stock market can still do very well through tax hikes, it can create a headwind as company profits and consumer spending may be lowered.

Healthcare stocks have rallied after the initial election results as major healthcare reform is also unlikely without Democratic control. It is also less likely that major climate change legislation is passed as long as Republicans remain in control of the Senate.

Some pieces of legislation are more likely to be passed by Congress with both Democratic and Republican support. Another round of economic stimulus is likely to be passed either in the last two months of 2020 or early 2021 as both parties want to help the economic recovery continue and the millions of people who are still unemployed.

Both sides have supported spending on infrastructure projects which could also help boost employment and the economy. Technology companies are likely to face greater scrutiny by both Democrats and Republicans who have feuded with the big tech companies for different reasons. However, strong action against these companies based on anti-competitive behavior seems unlikely without full Democratic control.

The market could face greater volatility if the presidential election results continue to be delayed. Our investment team will continue to look for opportunities if that is the case. Rest assured we will eventually have a winner and as we have previously explained, the market can perform well regardless of what political party is in the White House.