Sherpa Blog by Lance Gunkel: When Interest Rates Rise

by Admin | December 1, 2022

March 5, 2015

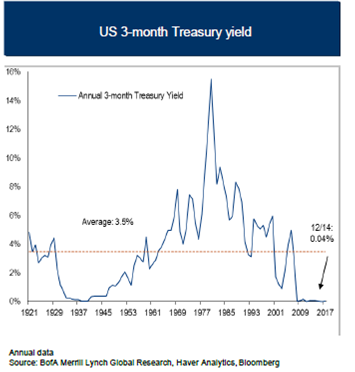

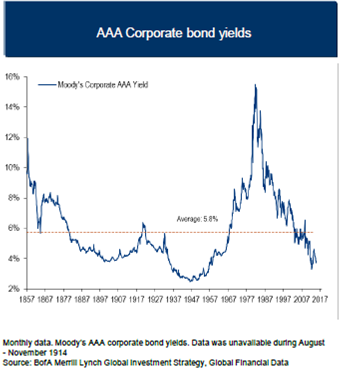

I’m bringing you two charts-of-the-day displaying interest rates over time.

As you can see, Treasury and corporate bond rates are at historic lows and well below average levels.

It’s wise to think about what may happen to your investments when interest rates finally move higher. The effects of rising interest rates include:

1. Bond prices fall, especially long-term bonds. (BAD FOR BOND INVESTORS IN THE SHORT-RUN)

2. Companies face higher borrowing costs, making the cost of doing business more expensive (BAD FOR STOCKS)

3. Individuals face higher borrowing costs, so they will tend to spend less (BAD FOR BUSINESSES = BAD FOR STOCKS)

4. Individuals are tempted to save more (and spend less), since their savings now generate greater interest income (BAD FOR STOCKS, GOOD FOR BONDS IN THE LONG RUN)

5. Bonds start becoming more attractive relative to stocks now that rates are higher (GOOD FOR BOND INVESTORS, BAD FOR STOCKS)

The summary above is very simplified, as there are many more implications. However, it’s easy to see what typically happens in a rising interest rate environment:

- Bonds are initially hurt and fall in price

- Longer term, bonds are aided as investors move back to the bond market due to higher interest

- Stocks are hurt (Businesses face higher costs, consumers spend less, and bonds are more attractive)

Is your portfolio positioned to tackle rising interest rates? Are you prepared to dynamically shift allocations as the interest rate environment changes? We can take that burden off your shoulders and navigate your way through the financial landscape.

-Lance