Coronavirus Update: April 17, 2020

by Jason Gunkel CFP® CFA CAP® Chief Investment Officer | April 16, 2020

The U.S. stock market (as represented by the S&P 500) has had a relatively tame week compared to recent ones. The market fluctuated up and down for most of the week and looks on track to have a gain of about 2%. The market has actually experienced a nice rally since it bottomed on March 23, returning about 25%. However, year to date the market is still down close to 13%.

One of the biggest headlines of the week came with the release of new unemployment claims on Thursday. An additional 5.2 million people filed for unemployment the week ending April 10, according to the Department of Labor. 22 million people have filed unemployment in the last four weeks, which is the net number of jobs created in 9.5 years following the end of the last recession. That means the unemployment rate has likely jumped above 15%, which is the highest it has been since World War II.

Many of those who filed for unemployment are likely still getting paid for a few months, thanks to the stimulus package passed by Congress that pays businesses to hold employees on payrolls. The nearly $350 billion in the lending program reportedly has been used up this week, according to the Small Business Association, and Congress is struggling to reach a new deal to replenish the funds. Meanwhile, an agreement was reached with the major airlines for the government to provide a $25 billion bailout package as part grant and part loan.

With the mounting unemployment numbers, there is increasing pressure to start reopening parts of the economy. President Trump announced on Thursday new guidelines for states to lift some restrictions on business activity. He is leaving the decision up to the governors of each state, with many indicating they will remain more cautious.

The week is ending on a more positive note with promising results from an experimental drug as part of a clinical trial to treat the COVID-19 virus. So far, the drug is a front-runner in the race to develop a treatment for the virus, but full clinical trials are still required according to the University of Chicago Medicine.

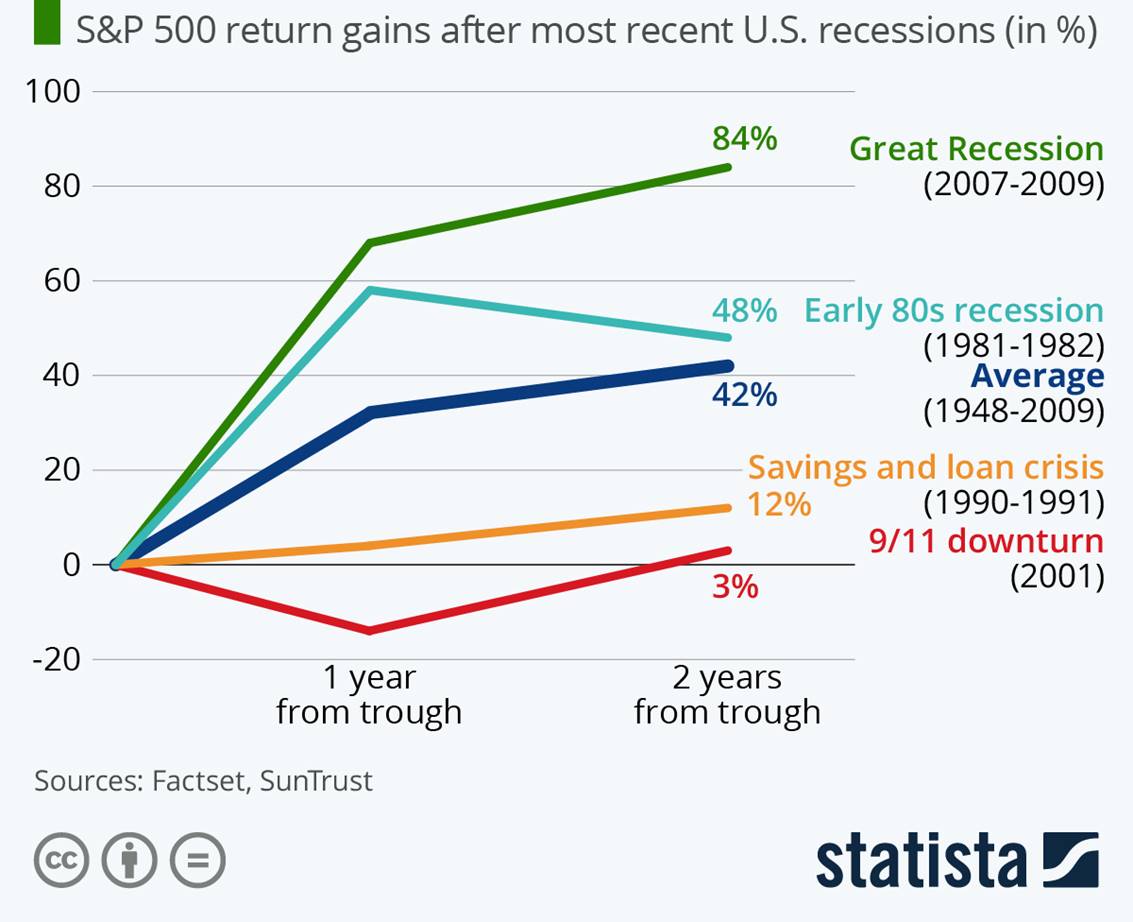

The graph below provides more encouragement this week by showing a graph of stock market recoveries after recent U.S. recessions. The market has experienced swift gains after going so low. It is yet to be seen if we have reached the bottom, but it is important to continue to trust your financial plan and stay invested.