Coronavirus Update: September 4, 2020

by Jason Gunkel CFP® CFA CAP® Chief Investment Officer | September 3, 2020

The stock market as represented by the S&P 500 Index, had what some analysts call a “perfect week” last week (ending August 28) with it rising for five consecutive days and hitting new all-time highs each day. That run continued this week, but came to an end on Thursday with a big market drop of 3.5%. It was the market’s worst day in nearly three months dating back to June 11 when it lost nearly 6%.

The market is officially in a new “bull” market and has had the fastest recovery in history to a new high following a decline of at least 30%, according to Charles Schwab. The market is up about 8% year to date and as explained in a previous article, that is largely due to technology stocks that are up over 30% on the year (as represented by the S&P 500 Information Technology Index).

The stock market drop on Thursday and Friday seemed to be a result of investors trying to digest new employment information. On Thursday, the U.S. Department of Labor reported that another 881,000 people filed for first-time unemployment insurance benefits last week. That number was below expectations, but still stubbornly high.

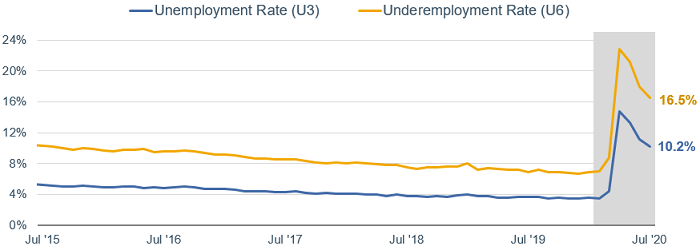

On Friday, the U.S. Department of Labor released their monthly jobs report and said almost 1.4 million jobs were added to the economy in August, which met analyst estimates. However, because the stock market is much further ahead of the economy in its recovery, it seems more difficult for economic data to meet rising investor expectations. The unemployment and the underemployment rate remain elevated at over 10% and 16% respectively.

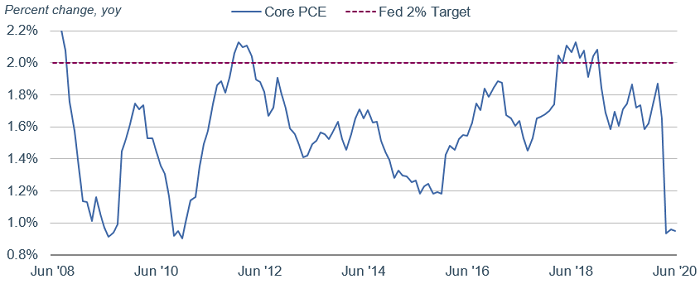

The Federal Reserve made a lot of news this week. Current and former Federal Reserve officials said that they may have made a mistake after the last financial crisis in 2008 by raising interest rates too soon, which might have curbed job growth. Federal Reserve Chair Jerome Powell gave a speech entitled “Navigating the Decade Ahead,” and he indicated a shift in policy to an “average inflation target.” This is where the Fed will likely keep interest rates near zero for several more years until it sees inflation average 2% over a longer period of time. The inflation rate has averaged about 1.6% since 2012 which has been below the Fed’s 2% target.

Considering that inflation remains very low and unemployment very high, the Fed has shifted its primary focus from keeping inflation in check to stimulating job growth, all according to Schwab. This more accommodative interest rate policy should provide a tailwind for the stock market.

Earlier this week, the market gained after news that the U.S. Centers for Disease Control and Prevention (CDC) had told states to prepare for a COVID-19 vaccine by November 1. Last month, the CDC told states to assume that limited doses of a vaccine could be available this fall, but a new letter said they are rapidly preparing to implement large-scale distribution of a vaccine by November, according to Bloomberg.

We can continue to hope and pray that a vaccine is developed soon, which would likely be beneficial to not only our health, but our investment portfolios as well!