How the Presidential Election Might Affect Your Portfolio

by Jason Gunkel CFP® CFA CAP® Chief Investment Officer | October 14, 2020

You may be surprised at what history tells us about stock market activity during past presidential cycles.

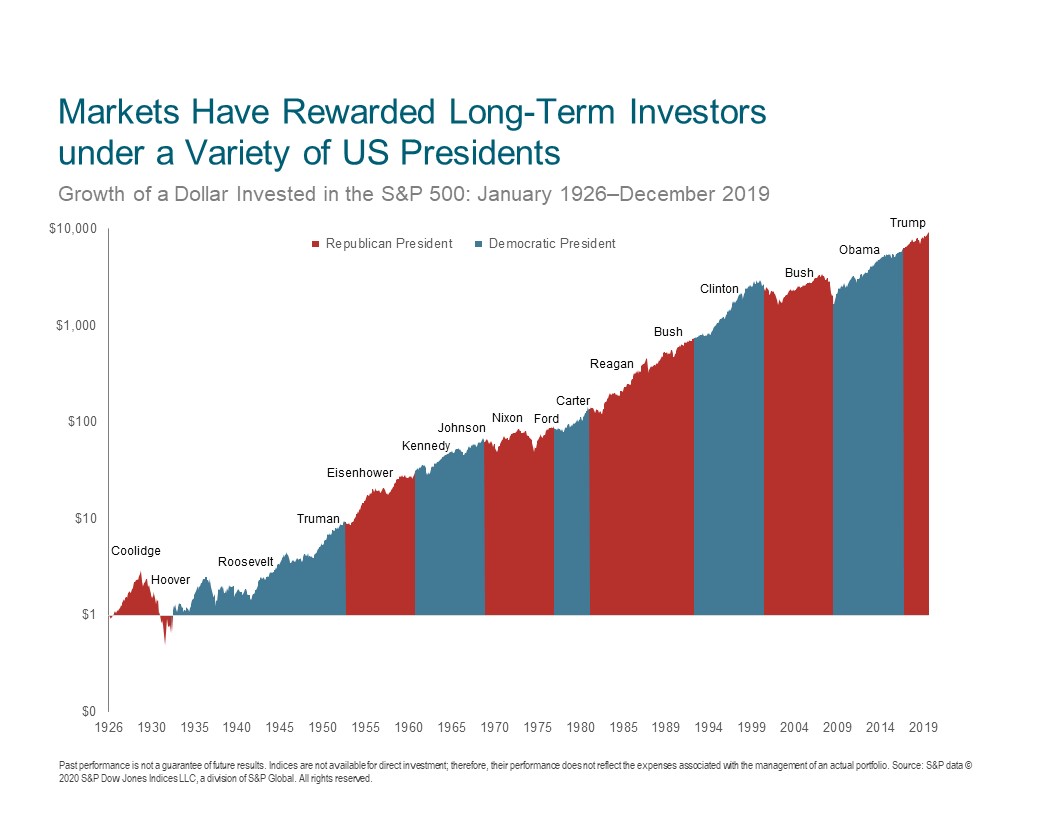

With the Presidential election only weeks away, many investors are focused on how the results could affect their investment portfolios. The good news is that the historical performance of the stock market shows that the market can do very well under both Democratic and Republican presidents.

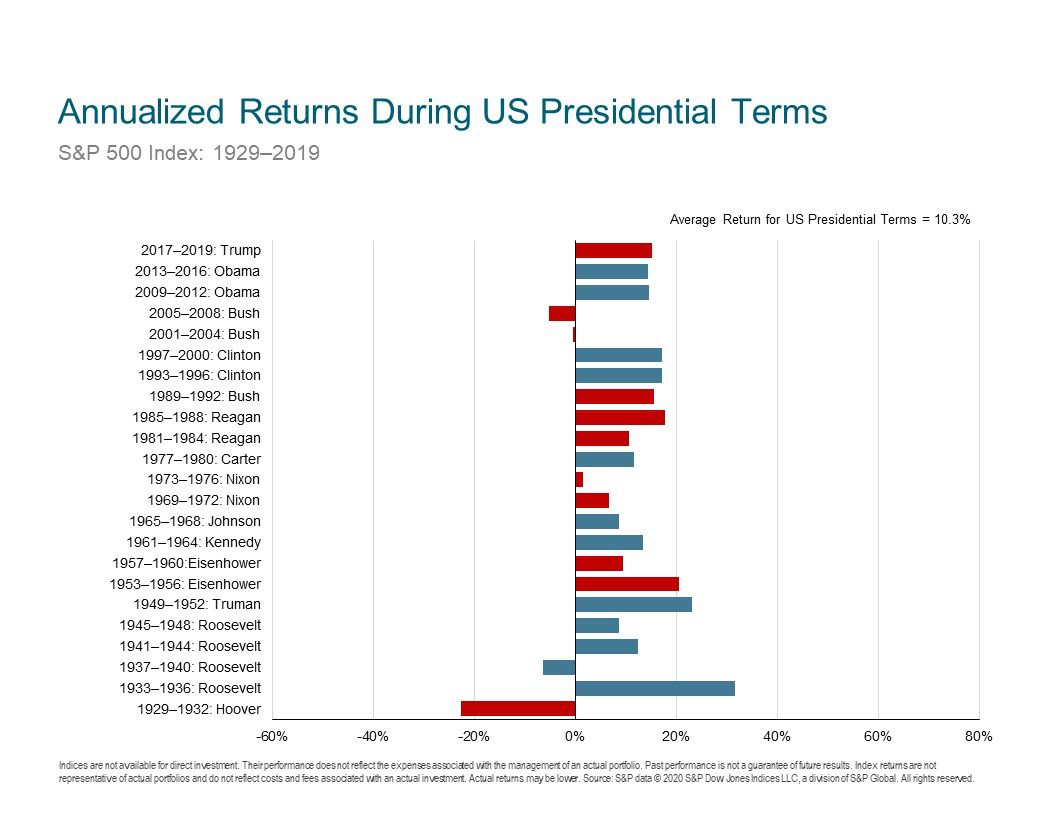

From 1929 to 2019, the average annual return over a four-year presidential term of the S&P 500 has been 10.3%. Democratic Presidents have averaged a better return (13.9%) than Republican Presidents (6.3%), according to DFA. These returns are significantly impacted by the terms of President Clinton and President Obama when the market averaged an annual return of 17.2% and 14.5%, respectively.

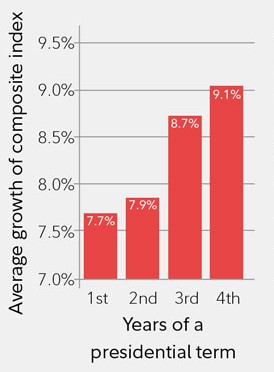

It is interesting to dissect these returns a little further. The four-year “presidential cycle” shows a fairly consistent pattern in which the first two years of a term have tended to produce lower returns than the last two years. The presumed reason for this is that during the first half of a term, the president’s agenda may take some time to work its way through Congress to become law, and eventually impact the economy. Then, in the last two years, the president is more focused on getting re-elected and usually attempts to boost the economy (and stock market) through fiscal stimulus of tax cuts or higher government spending.

Source: Fidelity. Monthly data since 1789 (mix of S&P 500, Dow Jones Industrial Average, & Cowles Commission).

It is also interesting to note that during the first two years of a presidential cycle, the stock market does better following a Republican win (+8.3% return) than a Democratic win (+5.8%). The difference is even more significant when the Republicans take control of both the White House and Congress (+12.2% return) than when the Democrats take control (+3.4% return).

The reason for this discrepancy in returns in the first two years following an election could be some conventional thinking that the Democrats are generally worse for the economy and the stock market because of their tendency to increase taxes, spending, and regulations. However, this conventional thinking does not turn out to be true over full four-year presidential terms. As shown above, the Democrats actually have a better average return over a four-year term than the Republicans.

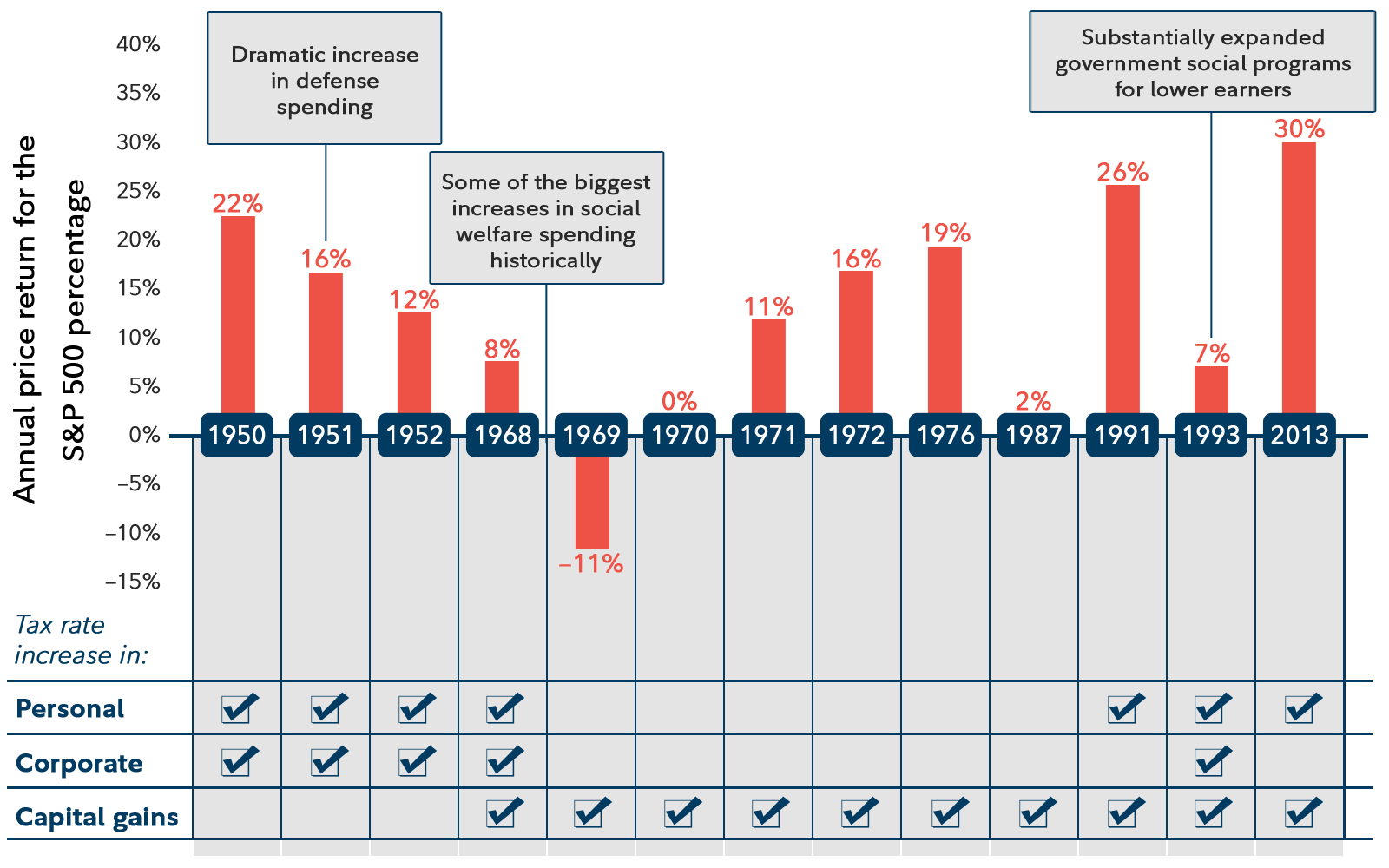

Some investors are concerned that if Democratic candidate Joe Biden is elected and raises taxes, it could be detrimental to the stock market. Thirteen previous instances of tax increases have occurred since 1950. Surprisingly, the stock market has usually not struggled during those years.

The average annual return of the stock market in those 13 years has been 12.2%, which is higher than normal. The tax increases don’t happen in a vacuum and there are many other factors that can drive the stock market, such as government stimulus programs or numerous economic events (technology boom, real estate bubble, global pandemic, etc).

Presidential policies can have much greater financial planning implications. Under former Vice President Joe Biden’s tax proposal, he wants to:

- raise the top marginal tax rate for incomes over $400,000;

- tax capital gains and qualified dividends for incomes over $1 million at higher ordinary tax rates;

- lower the federal estate tax exemption by 50% or more;

- eliminate stepped-up basis on transfers of appreciated property at death;

- and increase corporate tax rates.

(All according to the Schwab Center of Financial Research)

It is important to remember that it usually takes a long time to implement tax changes. Biden would need to be elected and the proposals would need to pass by a majority vote in both the House and the Senate.

Therefore, we advise people to avoid making major changes to their financial plans as long as these proposed tax changes remain highly uncertain to become law. However, if the Democrats regain control, we most likely will concentrate on reviewing clients’ income tax and estate planning strategies and be much less concerned about their investment portfolios.

As illustrated above, a conclusion could be made that investors are well served by sticking to their long-term investment strategy regardless of the political party in power.