Market Update: June 4, 2021

by Jason Gunkel CFP® CFA CAP® Chief Investment Officer | June 4, 2021

-3.png) The stock market had one of its more volatile months of the year in May, but continued its bullish run.

The stock market had one of its more volatile months of the year in May, but continued its bullish run.

After investors were again spooked by fears of excessive inflation, the S&P 500 Index dropped by as much as 4% before rebounding to finish May with positive growth of nearly 1%. The index is up about 12.5% year to date.*

Bond prices have continued to stabilize and the Bloomberg Barclays US Aggregate Bond Index finished in positive territory (+0.3%) for the month.*

There continues to be wide dispersion of returns among “value” and “growth” stocks and the various sectors. Value stocks that are defined as having lower prices relative to their underlying assets or earnings, and therefore are better “values” compared to their growth stock counterparts, are up nearly 18% on the year. In comparison, growth stocks are up about 8%.*

The Energy (+45%), Financial (+30%), and Real Estate (+22%) sectors which tend to have more value stocks have also continued to lead the stock market recovery this year by a wide margin.

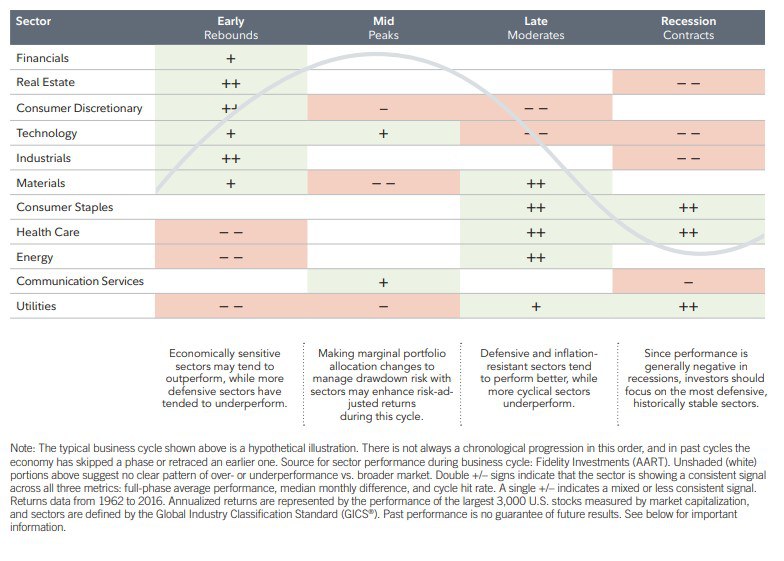

The U.S. economy is somewhere between the early and mid stages of an economic cycle, ahead of most of the developed economies, but behind China, on the curve. The table below summarizes how the various economic sectors tend to perform during each phase of the economic cycle.

While the current business cycle has been unique in the fact that it has been accelerated with the recession (caused by the pandemic), and swift recovery aided by vaccines and government stimulus, it has been more normal in regard to the performance of sectors. The more value-oriented sectors suffered the most during the recession but have performed the best during the recovery, as they typically do.

It is also worth noting that value stocks consistently outperform growth stocks over longer periods of time. Over 10-year rolling periods from 1926-2020, value stocks have outperformed growth stocks over 80% of the time, according to research by Dimensional Funds. That is why we tilt our portfolios toward value stocks over the long-run but will make adjustments through different phases of the economic cycle.

Perhaps one of the biggest perceived risks to the economic recovery is excessive inflation.

Hopefully you are not currently in the market to buy a car or build a house. According to the U.S Department of Labor, used car prices have increased 21% over the last year and lumber prices have risen 400% from their low in 2020!

While inflation has certainly been on the rise, it has been caused primarily by disruptions in the supply chain due to the pandemic, temporary production facility closings, and shipping congestion that appears to be slow to improve.

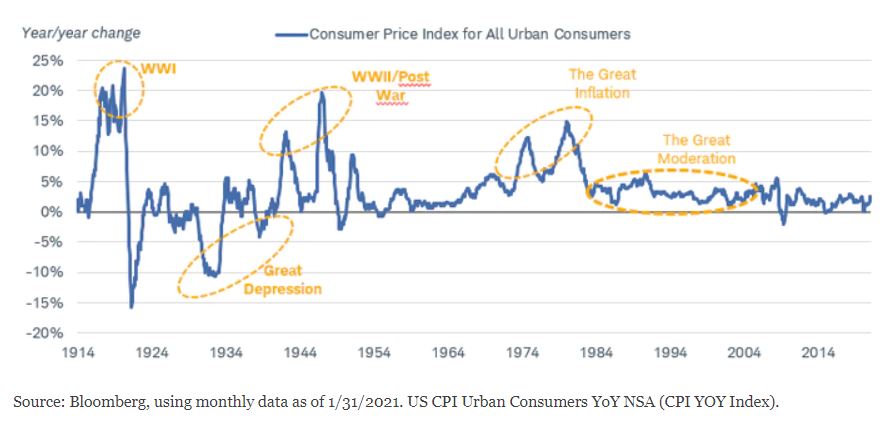

The surge in prices has reminded people of the high inflation of the 1970’s. However, let’s briefly review three reasons why we believe the U.S. is unlikely to revisit a long period of high inflation.

Demographics Have Changed

In the decade of the 70’s, the ratio of young (ages 25-34) to middle-aged (ages 45-54) workers was at record-high levels and much higher than it is today with the baby boomer generation entering their prime working and spending years, according to data from Organization for Economic Co-Operation and Development (OECD).

This “wave” of young workers created high demand for goods and services that boosted inflation. It began to decline in the 1990s and bottomed out around 2010. While this young-worker ratio is climbing today as the millennial generation enters their spending years, it is not expected to be anywhere close to that of the 1970s and the baby boomer generation.

Labor Market Structure is Different

In the 1970s, unionization was much higher and workers had much stronger bargaining power than today. As a result, wages tended to keep pace with inflation and comprise a much larger share of GDP, according to data from the St. Louis Federal Reserve. In addition, other structural changes such as globalization and technological advances have kept wage growth low. While some growing political pressure exists to increase wages and income inequality, wages have a long way to climb to compare to the levels in the 1970s.

Government Policy Can Influence Inflation

When President Nixon took office in 1969, he was highly motivated to lift the economy out of a recession and he steered government policy to be inflationary. He severed the dollar’s ties to the gold standard, increased government spending, did not raise taxes, and pressured the Federal Reserve to keep interest rates low.

In addition, tensions in the Middle East led to an oil embargo in 1973 which caused oil prices to skyrocket. This created the perfect storm for high inflation which averaged over 7% annually during the decade of the 70’s, all according to information from Schwab.

There are some similarities to government policy today and the Federal Reserve is making a transparent decision to let inflation “run hot” for the time being as we come out of a recession. The Fed has a difficult job conducting a balancing act between economic growth and inflation. However, if inflation rises above their target for long, the government and Federal Reserve can make the decision to control it as Fed Chair Paul Volcker decided to do near the end of the 1970s.

In summary, we think inflation is unlikely to be the reason this market rally stops. Rather, it will likely be the naturally slowing economic and earnings growth as we work our way through the business cycle.

In summary, we think inflation is unlikely to be the reason this market rally stops. Rather, it will likely be the naturally slowing economic and earnings growth as we work our way through the business cycle.

While the performance of various sectors of the market are continuously changing, our investment team will continue to evaluate which areas of the market in which we prefer to invest. The good news is that the options are typically plentiful until we face our next recession, which barring something unforeseen (like a pandemic), which we feel will probably not be anytime soon.

*Data according to morningstar.com