Market Update: May 7, 2021

by Jason Gunkel CFP® CFA CAP® Chief Investment Officer | May 6, 2021

-Dec-01-2023-05-58-06-2617-PM.png)

The “bull” stock market rally continued in April with the S&P 500 index climbing another 5%. That put the stock index up nearly 12% year-to-date as stocks seemed to get a boost from strong earnings results.

Approximately 60% of the companies in the S&P 500 have reported earnings results for the first quarter, and 86% of them have exceeded expectations, according to FactSet. If this number holds for the quarter, it would be a record high according to Schwab. Given last year’s earnings plunge caused by the pandemic, much better results were expected this year, but we feel the recovery has been remarkable.

The global growth forecast of 6% for 2021 would be the fastest pace of growth in 50 years as projected by the International Monetary Fund. The world economy likely rebounded back to its pre-pandemic output level in the first quarter, according to Bloomberg Economics. That would be the fastest “V” shaped economic recovery in history with a recession and recovery within only five quarters.

Over the last 40 years, it has taken an average of almost four years for the U.S. economy to fully recover from a recession, according to Zacks Investment Research. The U.S. economy is among the leaders in the global recovery with economic growth expected to be between 6-8% this year, which would be the highest annual growth since 1983, according to Schwab.

As for bonds, prices recovered a bit in April as interest rates stabilized. The Bloomberg Barclays U.S. Aggregate Bond Index was up over 1% for the month. The ten-year U.S. Treasury bond yield rose rapidly from about 0.90% from the start of the year to about 1.75% at the end of March. However, in April the yield declined to about 1.60% as worries of excessive inflation eased for the time being.

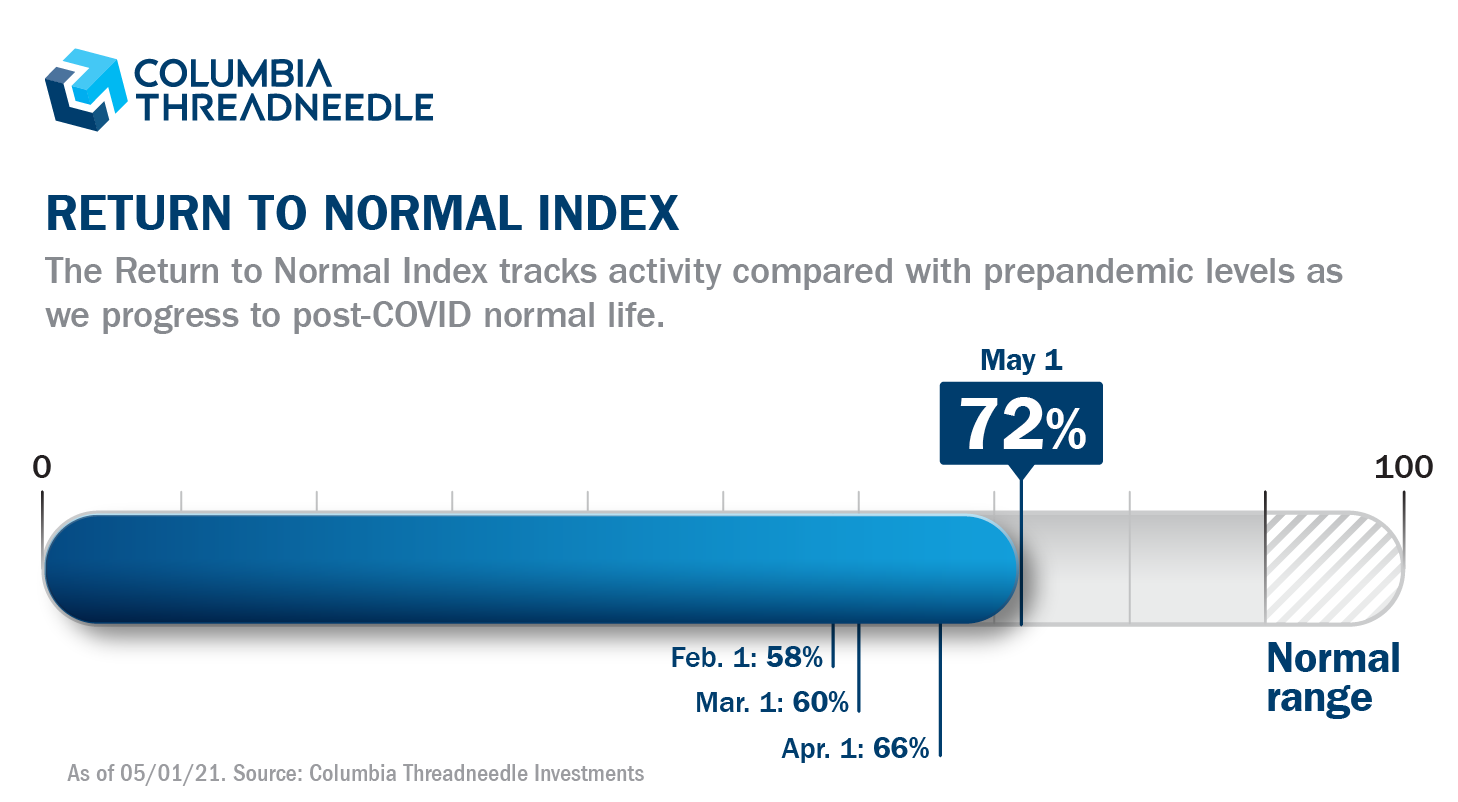

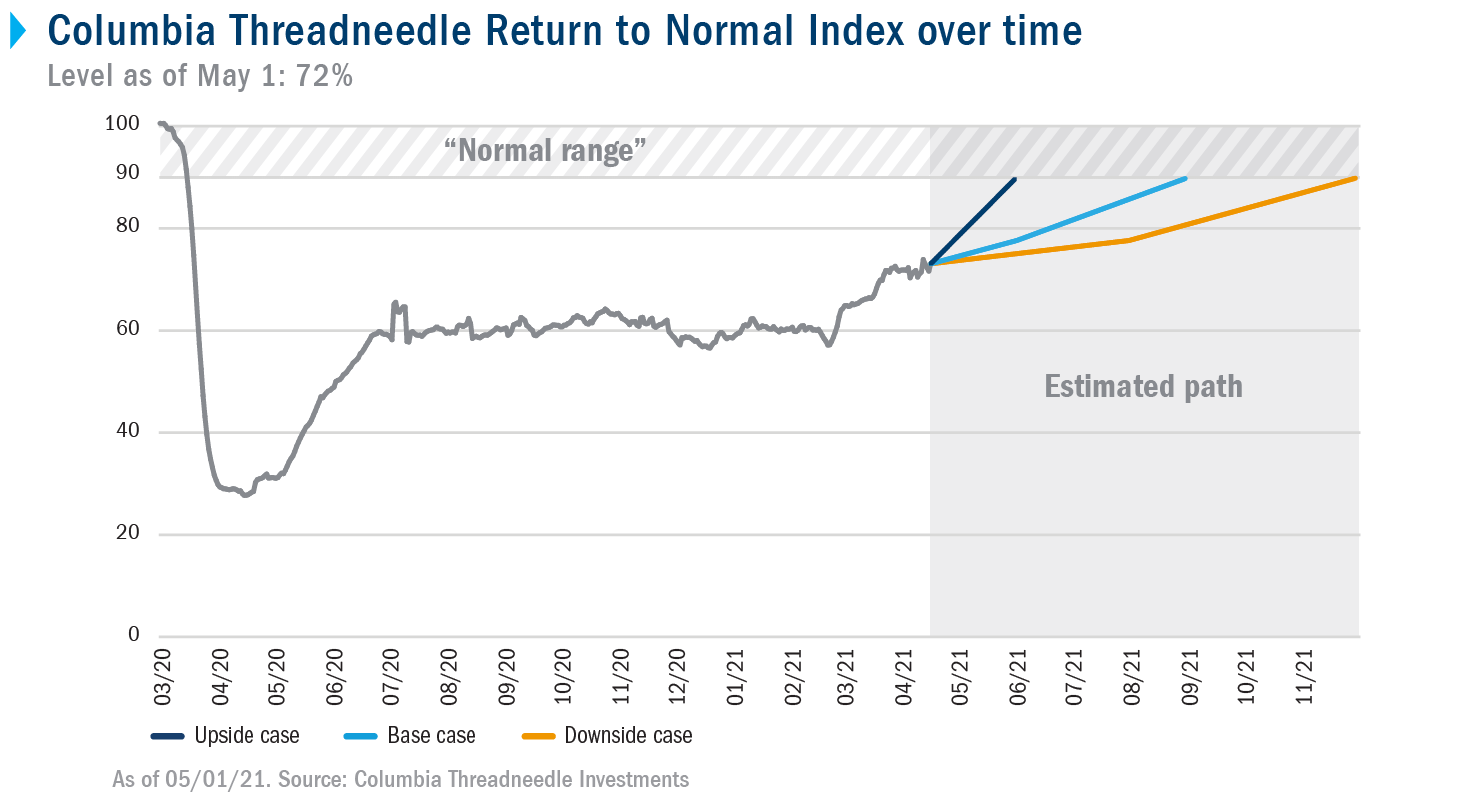

As the economy continues to reopen, it has become more evident that our daily lives are becoming more normal. Along those lines, investment company Columbia Threadneedle has created a “Return to Normal Index” which tracks components of daily life rather than economic data to measure the recovery relative to pre-pandemic levels. Some of the components include people returning to a more normal school and work routine, travel and entertainment, and brick-and-mortar shopping.

As of May 1, this index was at 72%, which had climbed from about 60% to start the year. Most of the components are about 75% to pre-pandemic levels with the exception of travel and entertainment which is still lagging by 43%.

Columbia Threadneedle estimates that the U.S. could return to the normal range by August if there are no significant setbacks, which is their base case scenario. Reaching the normal range by the end of June is the best case and reaching it by the end of the year is their worst-case scenario. Many people have equated a return to normal life with herd immunity. About 32% of Americans are fully vaccinated, which is up from about 15% at the beginning of April. However, the pace of vaccinations has slowed considerably, and it is estimated that at least 70% of the population needs to be vaccinated to reach herd immunity, according to Johns Hopkins.

The stock market recovery has caused some to worry about rising valuation levels. The 12-month forward price-to-earnings ratio of the S&P 500 is about 22 compared to a long-term average of about 16, according to John Hancock. In addition, the stock market is very forward looking and much of the expected economic recovery could already be factored into stock prices. However, as long as interest rates continue to be near record low levels and the economy continues to exceed expectations, we would expect the stock market rally to continue.