Retirement Account Management for 401(k)s

by Jason Gunkel CFP® CFA CAP® Chief Investment Officer | February 19, 2024

A person’s 401(k) account is often one of their largest assets as they can defer a percentage of their salary into it and often their employer will provide a matching contribution of some sort. These contributions can grow to a significant amount over time.

Unfortunately, employees often do not get much guidance on how to invest their 401(k) money and must make many of these investment decisions on their own. Most plans provide a screened list of investments to choose from which consist largely of diversified mutual funds, but these funds can still have higher risk and have the possibility of losing large amounts of money in a given year.

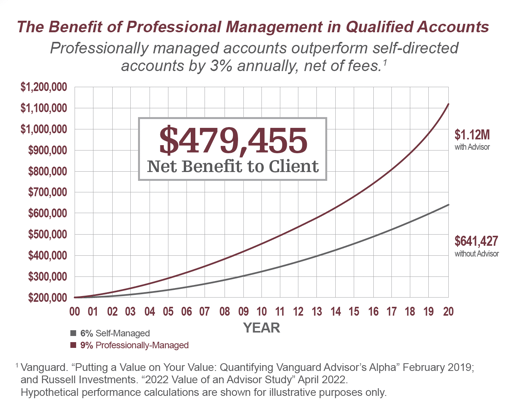

One of the biggest obstacles that investors have when managing their own money is that emotions can cause bad market timing decisions. For example, when the market drops people can become fearful and pull their money out of the stock market. On the flip side, when the market is doing well, people will often chase these good market returns and put more money into the stock market. This causes people to buy stocks at higher prices and sell them at lower prices. Vanguard’s Mind Gap Study conducted at the end of 2022 found that investors lost nearly 2% annually over the last decade from bad market timing decisions.

How Syverson Strege Can Help

So how can employees get professional advice on managing their retirement plan money? Luckily, some advances in technology now enable our company and other financial advisors to provide investment management services more easily for these types of accounts.

In the past, there were some obstacles for us to manage these assets efficiently. The employee would need to provide a recent statement for their 401(k) to show how their money was invested along with the full list of investment options available in the plan which often change. Then if we recommended investment changes, the client would need to figure out how to make the change on their own.

Now, a new technology platform helps to remove these obstacles. We can download a client’s current 401(k) investment positions daily, so we always have up to date information without them needing to provide statements. We also get access to all the investment options that are offered in the plan and automatically get notified when those options change. In addition, we can implement the recommended investment trades without the assistance of the client, making it a much more hassle-free service for them.

Meet RAM

We call this our Retirement Account Management (RAM) service. Clients using the service receive a quarterly report that summarizes their retirement plan holdings, investment fees, historical performance, and recommendations of specific investments and asset allocation. Once the recommendations are approved by the client, we can implement the trades using the new technology platform.

Check out our RAM webinar for additional information.

If you are interested in learning more about this service for assistance managing your employer-sponsored retirement account, please feel free to reach out to us at (515) 225-6000 or online!