Special Ukraine Edition - Market Update: March 4, 2022

by Jason Gunkel CFP® CFA CAP® Chief Investment Officer | March 4, 2022

The global financial markets have reacted strongly to the actions by Russia to invade Ukraine and the world is anxiously waiting on the next moves by Russia.

The global stock market as represented by the MSCI World Index had dropped over 10% since the beginning of the year to be considered an official market “correction.” However, the market continues to bounce back and forth daily as the Russia-Ukraine conflict evolves and the market is currently down about -8% year to date through March 2.

The market seems to be stuck in the middle of a tug-of-war game between positive economic news and the Russian invasion. Almost all of the companies in the S&P 500 U.S. stock market index have reported their earnings results for the fourth quarter and 76% of them have beaten their earnings expectations, according to FactSet. Corporate profit margins are the highest they have been in 70 years according to data from the U.S. Department of Commerce.

The U.S. Department of Labor’s most recent jobs report showed that 467,000 jobs were added to the economy in January which well-exceeded the expectations of economists. The department’s latest weekly unemployment claims report showed that jobless claims are the lowest they have been since the end of last year. The unemployment rate continues to trend downward and now sits at about 4%.

Supported by huge savings and strong wage growth, consumer spending continues to be strong and exceed expectations according to results released in February by the U.S. Department of Commerce. Consumer spending accounts for more than two-thirds of the U.S. economy and households are sitting on about $2 trillion of savings built up while not spending as much during the pandemic.

As the COVID-19 infections continue to drop, consumers are likely to boost spending further. In addition, the Commerce Department showed that business spending continues to rise and beat expectations in January as well. Morgan Stanley has revised its first quarter economic growth estimate from a 3.8% to 5.4% annualized rate.

While the human cost of war is not easily measurable and our deep sympathy goes out to those affected families, the Russian invasion creates a lot of uncertainty for the markets.

Western nations have responded by dropping severe economic sanctions on Russia. In addition, many Western banks and businesses announced they were halting operations in Russia and sales to Russian companies. The result has been a significant drop in the Russian stock market and the value of its currency. Many experts believe that Russia, the world’s 11th largest economy, could face a severe recession and a collapse of their banking system, according to the .

The sanctions have so far not targeted Russia’s energy exports because that would increase the risk of major worldwide economic disruptions including higher inflation. While the U.S. only imports about 3% of its oil and gas from Russia, the European Union relies on Russia for about 40% of its oil and gas.

So far Russia has been inclined to reap the benefits of higher energy prices but it could get desperate enough to retaliate and cut off its exports to Western nations. If that happens, Europe would likely be the most affected but other nations including the U.S. could feel the effects of even higher inflation than they are already dealing with.

Russia is the world’s largest exporter of wheat, and along with Ukraine, account for more than 25% of the world’s wheat supply, according to the Observatory of Economic Complexity. Many emerging market countries including Egypt and Turkey would be affected most by a drop in wheat exports. This could result in food shortages around the world sending inflation even higher.

Our portfolios have had insignificant holdings in Russian securities. Our primary investment vehicle for emerging market stocks held about 0.5% of its holdings in Russian companies compared to the peer average of close to 5%, according to Morningstar as of the end of February. Therefore, the drop in value of Russian companies should have very little impact on our portfolios.

There is no way to predict the future and we can hope that the Russian conflict does not expand. No two historical events are the same, but we can draw upon lessons learned from history on the impact of financial markets.

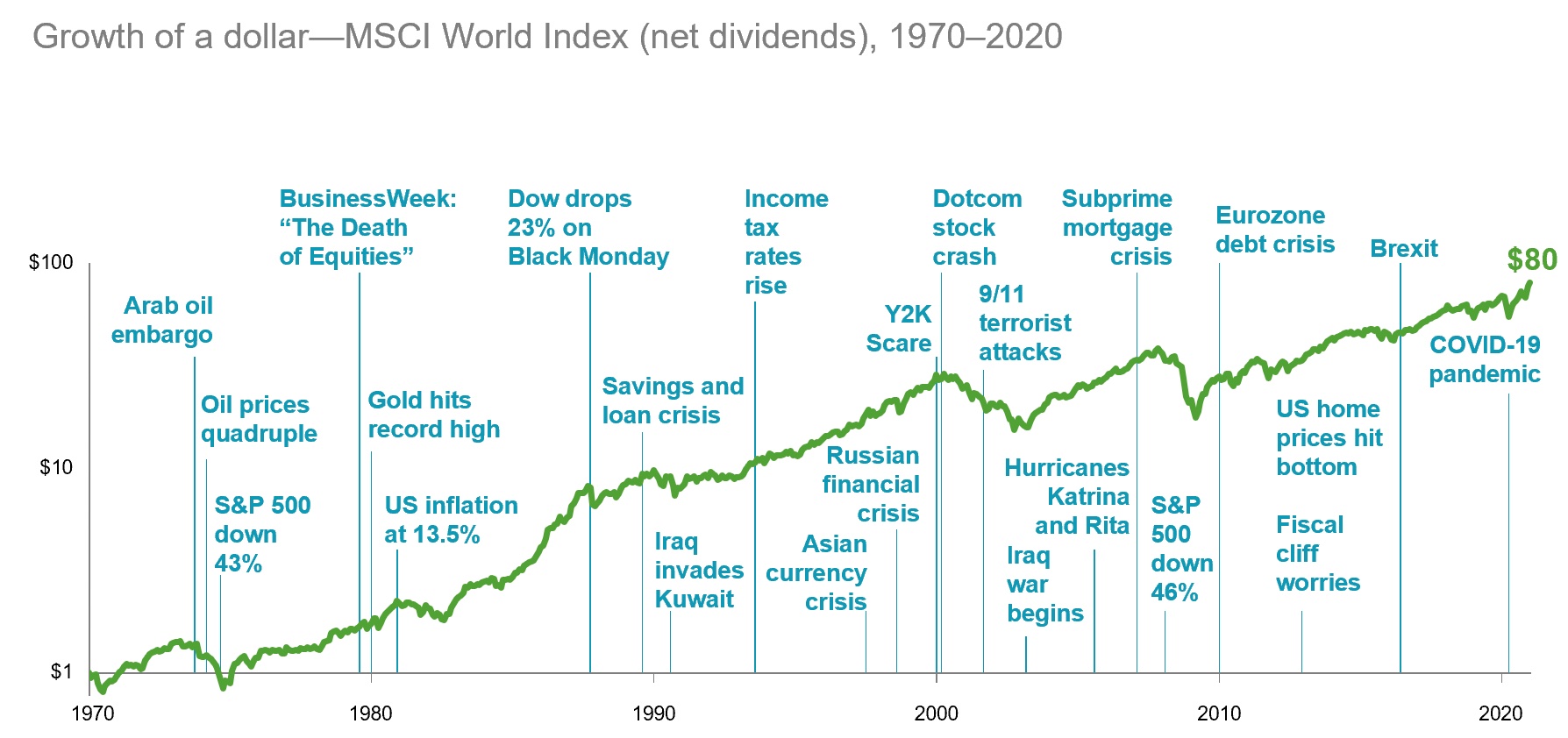

The chart below shows the growth of a dollar that was invested in the global stock market through past crises since 1970. While the market can drop during these events, it has always proved to be resilient and we believe this time will be no different. Investors who are able to look past the negative headlines are rewarded for their discipline and ability to stick with their investment plan.

Our investment team continues to monitor the markets very closely, including the events in Russia and Ukraine. It is important to remember that we have designed our portfolios to be diversified and resilient for events such as this. Therefore, we don’t see the need to make any immediate changes but rather want to stay the course and allow the asset allocation to work for our investors. We will stay committed to protecting the value of the accounts of our clients.

If you are a client and have concerns about how the Russian invasion is affecting your portfolio or other questions, please call your planner at 515-225-6000. If you are not a client and would like a complimentary, no-obligation, confidential consultation, please call us at 515-225-6000 to schedule.

In US dollars. MSCI data © MSCI 2021, all rights reserved. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is no guarantee of future results.