We’re Having a Baby! Now What? Creating a Financial Foundation for Your Children or Grandchildren

by Syverson Strege Commentary | June 5, 2023

We have all likely experienced the thrill of finding out we, or someone we know, is becoming a new parent or grandparent. There is so much to be excited about! As a new parent myself, I know firsthand how much joy and excitement comes with a new baby. With all the excitement, however, can come an overwhelming sense of financial responsibility as parents welcome their little one home. Taking steps now could help both you and your children or grandchildren start off on a strong financial footing. This article will take you through many of the different strategies for parents – and even grandparents – to utilize to hopefully help their children (and themselves) along the way.

For Parents:

For Parents:

According to AARP.org, only 40% of Americans have an estate plan. More staggering is that 78% of millennials do not have estate documents in place. Having a new baby is a great time to review your estate documents or maybe even have them drafted for the first time. It is important to work with a licensed estate attorney so that your children are not left picking up a financial mess. Some basic documents such as a will, living will and power of attorney are a good starting point. These documents will outline what happens to your assets, who becomes the guardian of your children, and who is responsible for making decisions if you are unable to do so.

An important piece to navigating finances and children can be creating a testamentary trust. This is a trust that is written into your will (see above) and becomes active if you were to pass away prior to your children being of age and maturity to handle the newfound wealth. In this trust you can outline parameters for how the money is used and when the money is paid out to the children. It is common for parents to put parameters in a testamentary trust for the funds to be used for the health, education, maintenance and support of their children. Then, for example, at age “X” 30% of the funds would get distributed to the child(ren) and the remainder at age “Y”. Having a testamentary trust is a crucial piece of the financial puzzle to help ensure that children prior to a certain age are not tasked with managing assets that they are ill-equipped to manage should their parents die prematurely.

Inevitably, with more kids in the house, sickness will likely increase. Funding a Health Savings Account (HSA) or Flexible Spending Account (FSA) could be a way to proactively save for those upcoming expenses on a pretax basis which will lower your adjusted gross income (AGI). It is important to understand the differences between an HSA and an FSA and the eligibility requirements of each. An HSA and an FSA act similarly in that you can contribute to one or the other annually and money can come out of them tax free if used for qualified medical expenses. Here are the differences:

| Health Savings Account (HSA) | Flexible Spending Account (FSA) |

| You can only contribute if you are on a High Deductible Health Plan. | You do not need to be on a High Deductible Health Plan to contribute. |

| Balance can be rolled over from year to year. | “Use it or lose it” balance must be used in the year you contribute and cannot be rolled to the next year. However, some employer-sponsored plans will allow a small amount of carryover ($610 in 2023). |

| You can change the contribution amounts. | Must elect how much to be contributed at beginning of year and cannot be changed unless family status changes. |

| If balance is not used by age 65, the funds can be used much like an IRA. (Distributions are subject to income tax but no penalty.) | |

| The maximum contribution if you have family coverage in 2023 is $7,750. | The maximum contribution in 2023 is $3,050. |

| Balance can be invested. | Balance cannot be invested. |

Source: https://www.irs.gov/publications/p969

It is important to note that an HSA and an FSA can be utilized even if you do not have kids. However, contributing to an HSA prior to having children can be a great way to save for the expense of the delivery as well as any other unforeseen medical expenses along the way.

If childcare expenses are on the horizon, understanding your options for how to tax efficiently pay for those expenses could be a valuable step to take. There are two primary options: funding a Dependent Care Flexible Spending Account (DCFSA) or claiming the Dependent Care Tax Credit. In some cases, you could do both. A DCFSA allows you to pay childcare expenses up to $5,000 (if married filing jointly) tax free in 2023. If your employer allows you to contribute, the funds that go into the account will lower your adjusted gross income and are not taxed when they are withdrawn to pay for qualifying childcare expenses.

Unlike the DCFSA, the Dependent Care Tax Credit is a way to receive a credit toward your tax bill for any qualified childcare expenses. This credit is not refundable, meaning it cannot increase a possible refund, only lower possible taxes owed. This credit is available for expenses up to $3,000 for one dependent and $6,000 for two or more in 2023. Generally, 20%-35% of those qualified expenses will apply to your taxes owed resulting in a maximum available credit of $1,050 and $2,100, respectively. This credit is subject to income limitations.

Regardless of whether you incur childcare expenses, families with qualified dependents younger than 17 may benefit from claiming the Child Tax Credit. This credit is a partially refundable credit. In 2022 the credit was $2,000 per qualified dependent subject to the parent's or guardian’s income. Up to $1,500 of the credit was refundable.

For Parents and/or Grandparents:

Saving for college can be a daunting goal. Luckily, there are options available to help ease the burden. One education savings vehicle available is a 529 College Savings Plan. A 529 plan is a way to save for college, receive a state income tax deduction in Iowa, grow the funds tax deferred and use those dollars tax free for qualified education expenses.

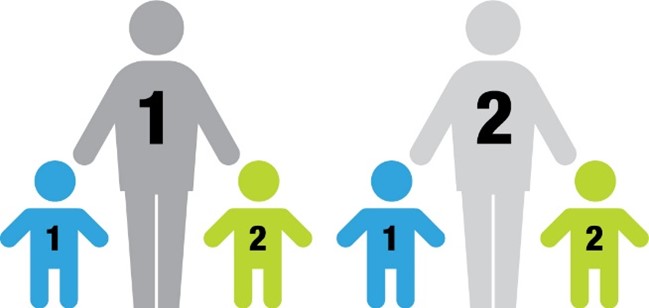

Per College Savings Iowa (collegesavingsiowa.com), in 2023 Iowa taxpayers can deduct up to $3,785 of their 529 contributions per beneficiary they contribute to. For example, you could contribute $3,785 to your daughter’s 529 and $3,785 to your son’s 529 plan and receive a total Iowa tax deduction of $7,570. In this example, if each parent did this for each of their two children, the family’s total deduction could be $15,140. All contributions do count toward your annual gift tax exclusion amount; however, there is a special five-year provision that allows you to use five years of annual exclusions to make one large, tax-free gift in one year.

$3,785 + $3,785 + $3,785 + $3,785 = $15,140

Deduct up to $3,785 per beneficiary account.

Source: https://www.collegesavingsiowa.com/home/why-choose-college-savings-iowa/tax-benefits.html

Many parents and/or grandparents want their children to have some money to help them get started once they become adults. Utilizing a Uniform Transfers to Minors Act (UTMA) or Uniform Gifts to Minors Act (UGMA) account could be a way to help you do that. As the parent, grandparent or guardian, you can contribute to this account for the benefit of your child. Funds can be used for the health, education, maintenance and support of that child prior to the age of majority (age 21 in Iowa) and cannot be used for your own personal benefit. Once the child turns the age of majority then those funds become the child’s funds, and you no longer have control of the assets. Because these assets are technically the child’s, it will have a heavy impact if applying for college financial aid.

For the same reasons one may start a UTMA or UGMA account, many may want their child or grandchild to have funds available, but they are not comfortable with the idea of the child having full access to those funds at age 21. To alleviate that concern, you could consider opening a non-qualified account in your personal name with the proceeds transferable on death to the child or to the child in trust. Then you can have control over when you turn these funds over to the child. If you were to pass away prior to giving the child full access to these funds, they would transfer to the designated party at your death.

If you decide to give your children full control of the funds and transfer the account to their name, that is considered a gift and will count toward your annual and possible lifetime gift tax exclusion depending on the size of the account. In 2023, the annual gift exclusion is $17,000 per person ($34,000 per couple to any one person).

This can be a popular strategy to help a child save for a wedding, car or maybe even a first home down payment.

This is not an exhaustive list of all strategies available for you and your children and not all these strategies may fit your situation. Many of these strategies are also subject to factors such as income or gifting limits, contribution limits, qualifying dependent status and qualified medical or education expenses.

If you have made it this far you may be thinking you have things well squared away. Or maybe now you are more stressed about your children and finances than you were before reading this article. I get it! There is a lot to think about, and we are here to help. At Syverson Strege, we know every situation is different and we can help you navigate the rules and limits that come with various strategies. Please reach out at (515) 225-6000 and allow us to assist with building a customized plan for you and your child’s future.

Internal Revenue Service. Internal Revenue Service, www.irs.gov/publications/p969. Accessed 11 May 2023.

Expert, TurboTax.TurboTax, 15 Mar. 2023, turbotax.intuit.com/tax-tips/family/the-ins-and-outs-of-the-child-and-dependent-care-tax-credit/L2H7rzUWc.

College Savings Iowa 529 Plan. College Savings Iowa 529 Plan, www.collegesavingsiowa.com/home/why-choose-college-savings-iowa/tax-benefits.html. Accessed 11 May 2023.

AARP. 9 Dec. 2022, www.aarp.org/money/investing/info-2017/half-of-adults-do-not-have-wills.html