What Investors Need to Know About Rising Inflation

by Jason Gunkel CFP® CFA CAP® Chief Investment Officer | November 9, 2021

What was President Ronald Reagan referring to when he said, "It is as violent as a mugger, as frightening as an armed robber, and as deadly as a hitman?”

Believe it or not, he was actually referring to inflation!

So, is inflation really that frightening? The short answer is that low levels of inflation are not frightening at all and are actually good for the economy. Only when inflation is very high in the double digits (known as hyperinflation) can it be dangerous.

Hyperinflation can cause a number of negative consequences for an economy. When prices rise excessively, cash and savings deposited in banks decrease in value or can become worthless since the money has far less purchasing power. If people stop depositing their money in banks, it could lead to banks and lenders going out of business.

Tax revenues may fall if consumers and businesses can't pay, which could result in governments failing to provide basic services. People also may hoard goods and food because of rising prices, which in turn, can create supply shortages.

While hyperinflation can indeed be scary, inflation is actually a good thing when it is mild. The Federal Reserve has set the official inflation target at 2%, but has said that it is willing to allow inflation to run higher for shorter periods of time.

Inflation makes consumers expect prices to continue rising. When prices are going up, people want to buy now rather than pay more later. This increases demand in the short term. As a result, stores sell more and they are more likely to hire new workers to meet the demand. This helps to boost economic growth.

Mild inflation also removes the risk of deflation. That’s when prices fall and could be just as scary as hyperinflation. When that happens, people wait to see if prices will drop more before buying. It cuts back demand and businesses reduce their inventory. As a result, factories produce less and lay off workers. For this reason, deflation can be even more harmful to economic growth than high inflation.

What Causes Inflation?

Inflation occurs when demand exceeds supply in the economy. This happens when the economy grows faster than a country’s ability to provide the goods and services demanded by consumers.

It is often thought that the money supply or total amount of money in circulation in a country is a cause for inflation. However, the money needs to find its way into the economy and turn over rapidly to generate inflation, known as the velocity of money (the ration of money supply to GDP).

While the money supply has grown exponentially in recent years as the Federal Reserve has tried to stimulate the economy, the velocity of money has remained relatively low which has caused inflation to remain in check.

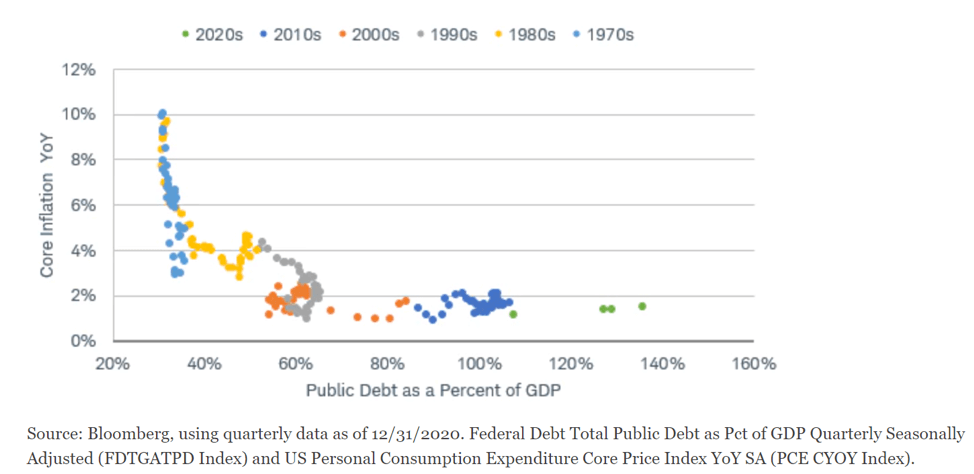

Some might also find it surprising that government budget deficits are not necessarily linked to inflation either. Government spending can stimulate the economy but tends to only create inflation if the demand it creates exceeds supply.

The chart below shows that in the U.S. since the 1970s, a negative correlation between the level of public debt and inflation has occurred. Only when a country’s debt level becomes so high that it cannot afford to make its debt payments will that country’s currency lose its value and hyperinflation will ensue.

Inflation has been rising rapidly in the U.S. this year because disruptions in the supply chain coupled with the economy rebounding from the pandemic have caused demand to exceed supply by a wide margin.

Inflation has been rising rapidly in the U.S. this year because disruptions in the supply chain coupled with the economy rebounding from the pandemic have caused demand to exceed supply by a wide margin.

The 12-month inflation rate rose to 5.3% in August according to the Bureau of Labor Statistics which is well above the Federal Reserve’s 2% long-term target.

Starting in the 1970s, the rise of the shipping container revolutionized global trade. These corrugated steel boxes can stack on ships and fit on truck beds. They dramatically lowered the cost and time to transport goods. This enabled businesses to shift production to lower-cost destinations overseas and source materials and components from just about anywhere, all according to Schwab research.

While this helped make many goods more affordable, the global trade system was not prepared for the shock of the pandemic. Shutdowns and layoffs at factories and port delays and closures are the main culprits of short supplies.

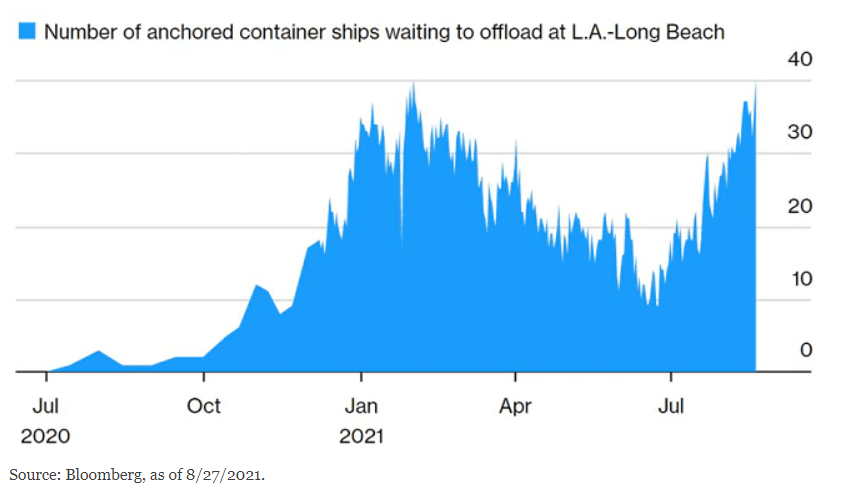

In fact, shipping logjams are back to the worst levels of the pandemic. One way this can be seen is to look at the rise in the number of containerships waiting to be unloaded in San Pedro Bay outside of the United States’ busiest ports of Los Angeles and Long Beach.

July and August had a steady rise in congestion back to the peak of February.

The next few weeks may continue the flurry of activity by companies to book containers for transit to have products available in time for holiday shopping.

Experts believe that it could take well into next year before the supply chain can work its way through the backlog. The consensus view from industry professionals is that the end of 2022 is a likely time frame for the supply chain issues to return to some form of normality, according to Drewry’s Container Forecaster report, an independent maritime research consultant.

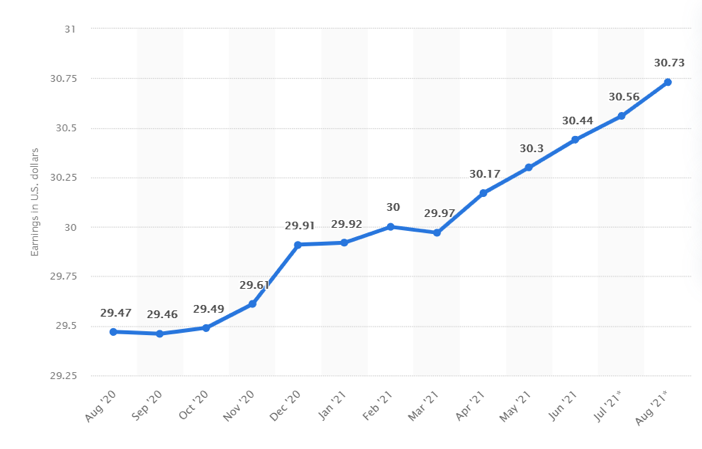

While the supply chain issues might be more “temporary,” another primary driver of inflation that could have a more lasting impact is rising wages.

Average hourly earnings rose 3.6% in June compared to a year ago. That’s the biggest spike since January 2009, according to data compiled by the Economic Policy Institute.

Source: Statista Research Department, Sept 6, 2021. Graph shows monthly average hourly earnings of U.S. nonfarm payroll employees as of August 31, 2021.

Source: Statista Research Department, Sept 6, 2021. Graph shows monthly average hourly earnings of U.S. nonfarm payroll employees as of August 31, 2021.

As particular industries such as manufacturing, food service, and transportation are desperate for workers, employers are being forced to increase wages.

Higher wages tend to be “sticky” because it is harder to lower someone’s wages after they have received an increase. Eventually companies will likely pass these higher wages on to the consumer by raising the prices of goods and services.

Fed Chairman Jerome Powell went to great lengths in his annual speech in August during the central bank’s Jackson Hole Economic Symposium to knock down concerns about rising wage pressures as well as inflation overall, despite consistently higher numbers.

“Today we see little evidence of wage increases that might threaten excessive inflation,” Powell said during the August 27 speech. Measures Powell said he follows point to “wages moving up at a pace that appears consistent with our longer-term inflation objective.”

Long-term Outlook of Inflation

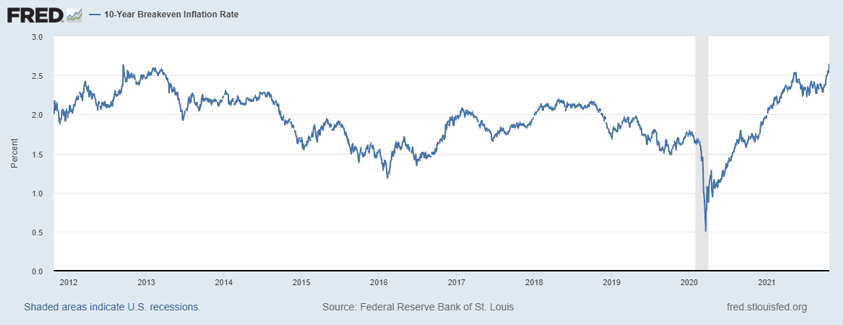

The recent surge in prices has reminded people of the high inflation of the 1970s. However, longer-term inflation expectations have remained modest.

The Federal Reserve has targeted a 2% inflation rate over the long term and are still confident they can achieve it. Investors are expecting inflation to exceed the Fed’s target but not by too much.

By looking at the difference in interest rates offered by the 10-year Treasury Bond and 10-Year Treasury Inflation-Protected Securities (TIPS), investors are expecting inflation to be about 2.6% (as of 10/22 according to data from the St. Louis Federal Reserve).

Let’s briefly review three primary reasons why we believe the U.S. is unlikely to revisit a long period of high inflation.

1) Demographics Have Changed

In the decade of the 1970s, the ratio of young (ages 25-34) to middle-aged (ages 45-54) workers was at record-high levels and much higher than it is today with the baby boomer generation entering their prime working and spending years, according to data from Organization for Economic Co-operation and Development (OECD).

This “wave” of young workers created high demand for goods and services that boosted inflation. It began to decline in the 1990s and bottomed out around 2010. While this young-worker ratio is climbing today as the millennial generation enters their spending years, it is not expected to be anywhere close to that of the 1970s and the baby boomer generation.

2) Labor Market Structure is Different

In the 1970s, unionization was much higher and workers had much stronger bargaining power than today. As a result, wages tended to keep pace with inflation and comprise a much larger share of GDP, according to data from the St. Louis Federal Reserve. In addition, other structural changes such as globalization and technological advances have kept wage growth low. While some growing political pressure exists to increase wages and income inequality, wages have a long way to climb to compare to the levels in the 1970s.

3) Government Policy Can Influence Inflation

When President Nixon took office in 1969, he was highly motivated to lift the economy out of a recession and steered government policy to be inflationary. He severed the dollar’s ties to the gold standard, increased government spending, did not raise taxes, and pressured the Federal Reserve to keep interest rates low.

In addition, tensions in the Middle East led to an oil embargo in 1973 which caused oil prices to skyrocket. This created the perfect storm for high inflation which averaged over 7% annually during the decade of the ‘70s, all according to information from Schwab.

There are some similarities to government policy today and the Federal Reserve is making a transparent decision to let inflation “run hot” for the time being as we come out of a recession. The Fed has a difficult job conducting a balancing act between economic growth and inflation. However, if inflation rises above their target for long, the government and Federal Reserve can make the decision to control it as Fed Chair Paul Volcker decided to do near the end of the 1970s.

How Investors May Protect Themselves Against Rising Inflation

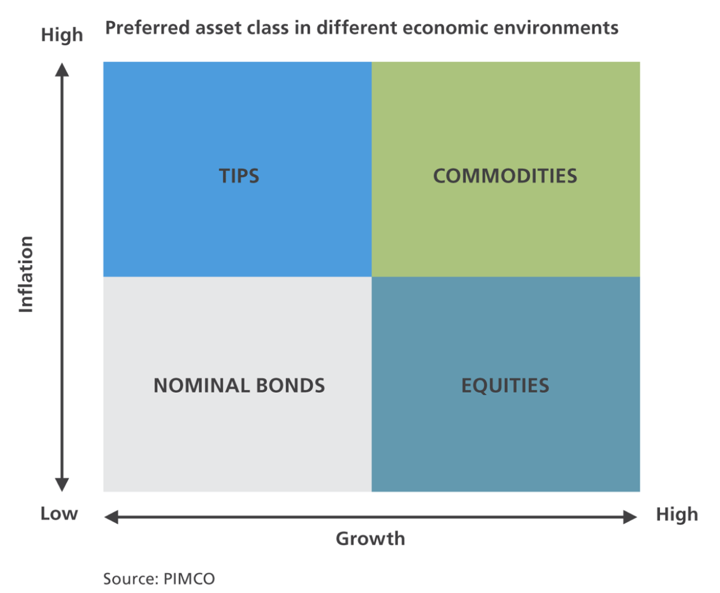

How should an investor protect against rising inflation? The answer not only depends on the level of inflation but also the level of economic growth.

If inflation remains relatively low, investors can protect themselves during times of low economic growth by investing in bonds. If economic growth is higher, investors can participate best in that growth through stocks.

During periods of higher inflation, an investor might need to diversify their portfolio with inflation-protected securities (TIPS) during periods of lower growth or commodities during periods of higher growth.

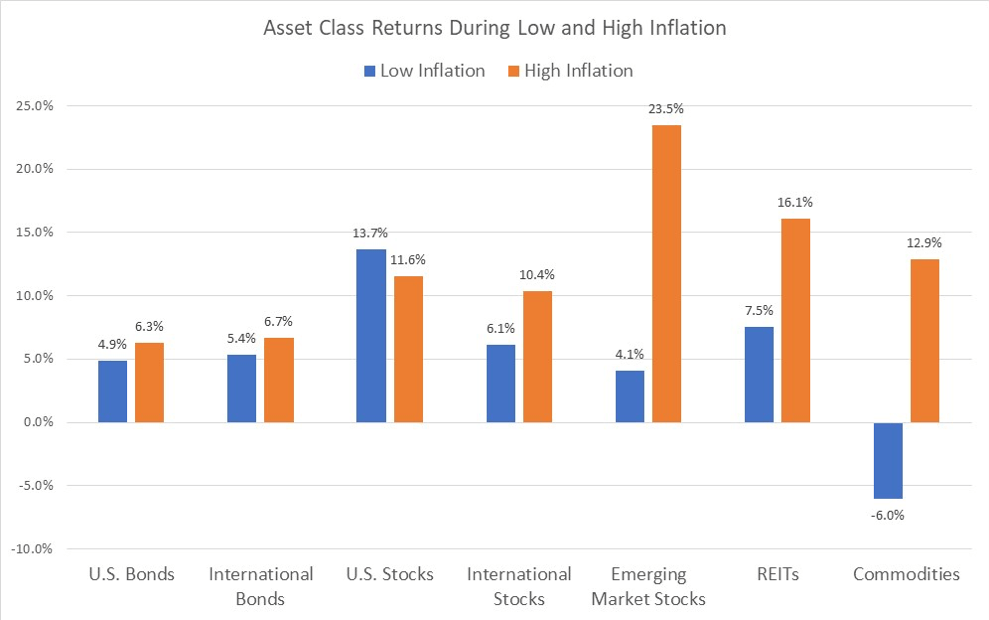

Let’s look a little deeper at how various asset classes perform during periods of low and high inflation.

Source: Dimensional Funds. Data shows average annual nominal returns during years from 1991-2020. Low inflation is defined as below the average and high inflation is defined as above the average over the specified time frame. U.S. Bonds = Five-Year Government Notes, International Bonds = Bloomberg Barclays Global Aggregate ex-USD Bond Index (USD Hedged), U.S. Stocks = Fama/French Total US Market Research Index, International Stocks = Fama/French International Market Index, Emerging Market Stocks = Fama/French Emerging Market Index, REITs = Dow Jones Select US REIT Index, Commodities = Bloomberg Commodity Total Return Index. Past performance is not a guarantee of future results.

According to Dimensional Funds, the best performing asset classes during periods of high inflation since 1991 have been Emerging Market Stocks (+23% average annual return), Real Estate Stocks (REITs) (+16%), Commodities (+13%), U.S. Stocks (+12%), and International Stocks (+10%).

The asset classes that have the greatest positive difference in returns between high and low inflationary periods are Emerging Market Stocks (+19% difference), Commodities (+19%), and Real Estate Stocks (+9%).

It is interesting to note that U.S. Stocks perform worse during high inflationary periods (+12%) than low inflationary periods (+14%), but their returns are still very strong on average during both environments.

As for bonds, one might find it surprising that they perform better during high inflationary periods on average. During these high inflationary periods, interest rates tend to rise as well. While bond prices initially fall when interest rates rise, the higher rates will also lead to higher bond yields and returns over time as the rates stabilize.

In summary, stocks might not perform quite as well during periods of higher inflation but still offer high returns on average during any environment. As inflation heats up, an investor would be wise to increase their allocations to real estate, commodities, and emerging market stocks to boost returns.

If you need a review of your investment portfolio or are interested in fee-only financial planning, please contact us at 515-225-6000 for a complimentary, no obligation, private consultation.