What is Values-Based Financial Planning and How is it Implemented at Syverson Strege?

by Matt Roberts MFM CFP® CAP® Chief Planning Officer | August 5, 2023

This is going to sound strange, but at Syverson Strege we believe that money is only important to the extent that it allows you to enjoy what you want to do. As our co-founder, David Strege, says, “Money is just a tool.” We refer to this concept as “values-based financial planning” which is based on a book written by Bill Bachrach in 2000 titled “Values-Based Financial Planning: The Art of Creating an Inspiring Financial Strategy.” If you are an existing client, you may have heard us bring this up before. But what is it exactly?

Values-based financial planning is about figuring out what you want out of life first and then designing a financial plan that serves as a roadmap to get you there. This sounds intuitive, but realistically it’s tempting to find solutions before you know where you’re going. This has often been the case in the financial advisor industry which historically has been sales-based. Insurance, annuities and investments often get sold first without fully considering how they get integrated into your financial life. It’s like starting to build a house without first designing a plan with an architect.

The first step is to understand what you value about money. At Syverson Strege, we guide our clients through a discovery process to determine your top five values. Some examples that come out of this conversation are “security,” “freedom” or “making an impact.”

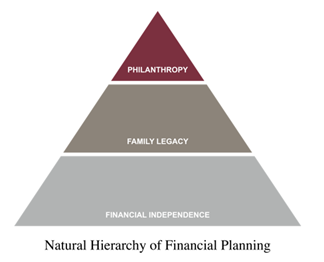

There are three components to your financial life: financial independence, family legacy and philanthropy. We use the pyramid below to help clients understand the natural progression of how values get prioritized working from the base to the top. Of course, there are no wrong answers through this process. The key is finding out what answer is.

The next step is to turn these values into specific goals. Perhaps one of your values is to feel secure, but what does that really mean? For many, that could mean ensuring you have enough resources to live comfortably for the remainder of your life. It’s important that you keep the following items in mind as you develop goals:

- Dream. Don’t worry about “how” for right now. It’s common to confine your thoughts to what’s feasible, but that limits the possibilities. Through the planning process, it’s our job to develop strategies to help you achieve your goals, so let us help figure that out.

- Make it tangible. A goal that is too vague will be hard to achieve. For example, a goal could be to build more wealth, but what’s the real underlying goal? Perhaps it’s being able to leave a specific amount to family or charity.

- Set a deadline. A common example is setting a retirement date. These dates are often selected based on what you believe is realistic or when people normally retire. Choose dates that have meaning to you.

- Prioritize. Life is full of tradeoffs. We would like to have it all, but for many, that’s just not possible. It’s helpful to categorize wants vs. needs to help allocate your resources to what you value the most.

Once goals are clearly defined, the financial plan can serve as the roadmap to ultimately get you from where you are now to where you want to be. It’s vital that these goals get revisited and retested on an annual basis. We want to help you experience the payoff of reaching the goals that align with your values.

If you’ve been dreaming about an idea, please don’t hesitate to reach out to the team at Syverson Strege so we can help make your dream a reality.