Coronavirus Update: July 2, 2020

by Jason Gunkel CFP® CFA CAP® Chief Investment Officer | July 2, 2020

After experiencing the worst quarter since 2008 in the first quarter of the year, the stock market (as represented by the S&P 500 Index) rebounded in the second quarter and had its best quarter in more than 20 years, climbing nearly 20%.

While the volatility in the stock market continued in the second quarter, investors seemed to focus more on the positives with the gradual reopening of the economy and the stimulus measures by the Federal Reserve and government.

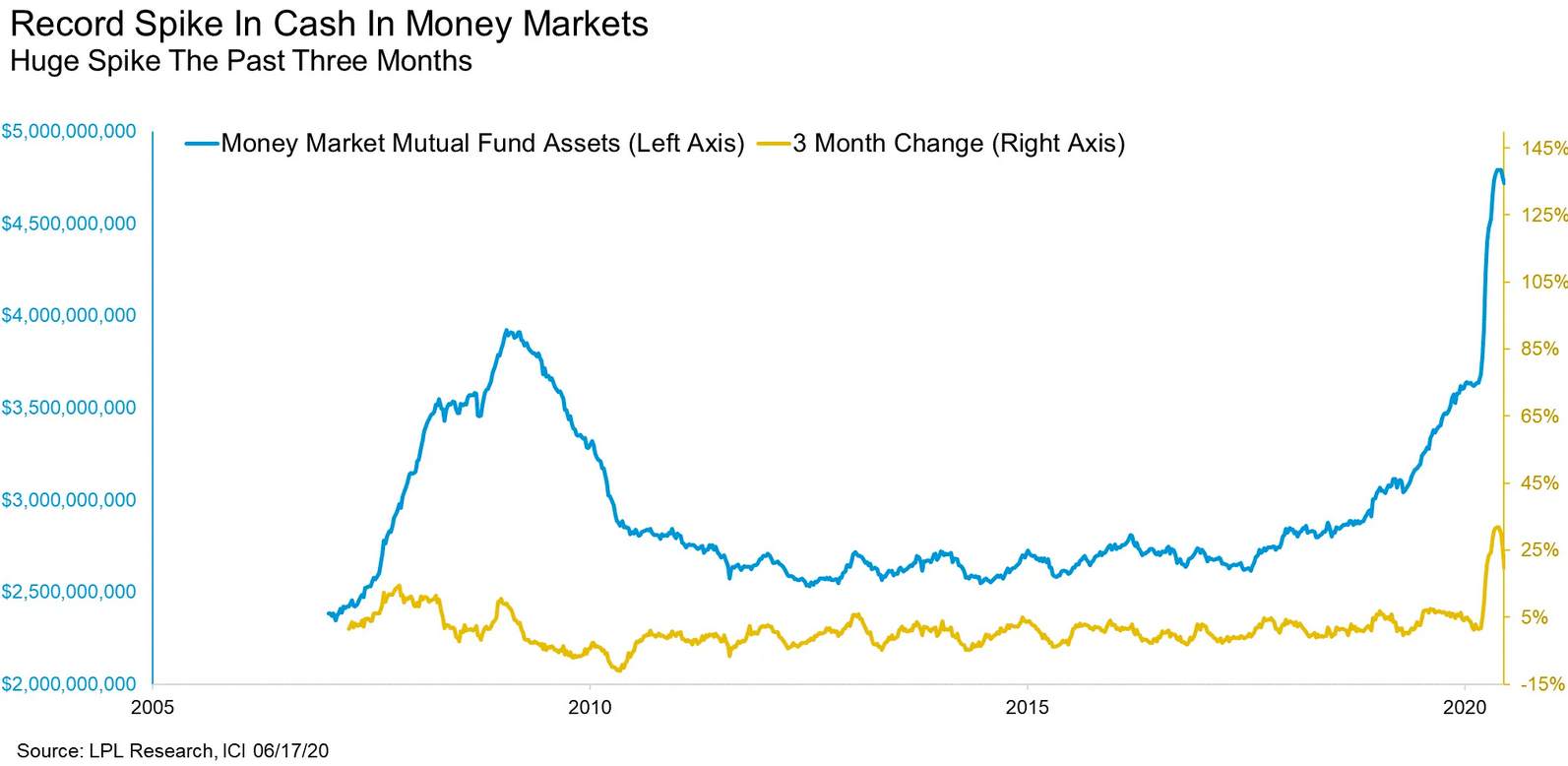

However, the volatility in the market has caused some investors to panic and flee the stock market entirely. According to research by LPL Financial as reported by , nearly 33% of all investors over 65 years old sold all of their stock holdings between February and May! The same research also showed that investors have moved to cash at a record pace. The second quarter saw the largest three-month increase in money market assets ever.

We have stressed the importance of staying invested in the market and not panicking during market drops. Moving to cash is usually the worst move that investors can make because they will almost certainly miss out when the stock market recovers. For example, after the S&P 500 reached its bottom this year on March 23, it proceeded to rebound over 17% in the next five trading days! Research from Morningstar indicates that over the last 15 years, investors missed out on returns of about 2.4% per year due to poor market timing decisions (based on investments in the Vanguard 500 Index Fund).

We have stressed the importance of staying invested in the market and not panicking during market drops. Moving to cash is usually the worst move that investors can make because they will almost certainly miss out when the stock market recovers. For example, after the S&P 500 reached its bottom this year on March 23, it proceeded to rebound over 17% in the next five trading days! Research from Morningstar indicates that over the last 15 years, investors missed out on returns of about 2.4% per year due to poor market timing decisions (based on investments in the Vanguard 500 Index Fund).

The elevated stock market volatility will almost certainly continue for the remainder of the year. The number of COVID-19 cases is seeing a resurgence in parts of the U.S. which has increased the uncertainty of the “shape” of the economic recovery that we will have (see May 15 article).

On the bright side, the unemployment numbers continue to get better as the economy reopens. The Department of Labor’s jobs report for June was released today and smashed expectations with 4.8 million jobs added during the month, which lowered the unemployment rate from 13.3% to 11.1%, according to Yahoo Finance.

With the increased volatility, we continue to advise our clients to not panic. As Warren Buffett said, “Be fearful when others are greedy and greedy only when others are fearful.” We will follow his advice and look for opportunities to buy when panicked investors sell, while sticking to a long-term investment strategy.